As the world of cryptocurrency continues to expand, the need for secure and reliable cryptocurrency storage has become increasingly important.

Digital assets require a safe haven, and that’s where crypto wallets come into play. But with so many options available, it can be daunting to decide which type is right for you.Learn the key differences between hot wallets and cold wallets for cryptocurrency storage. Discover which option offers better security, convenience, and control.

The main distinction lies between hot vs cold wallets. Understanding the differences is crucial for protecting your investments.

This article will guide you through the basics of crypto wallets, helping you make an informed decision about which one suits your needs.

Key Takeaways

- Understand the difference between hot and cold wallets.

- Learn how to choose the best crypto wallet for your needs.

- Discover the importance of cryptocurrency storage.

- Explore the benefits of using a secure crypto wallet.

- Find out how to protect your digital assets.

What Are HOT and COLD Crypto Wallets and Why Do You Need One?

A cryptocurrency wallet is a critical component in the crypto ecosystem, serving as a gateway to store and manage your digital assets. With the rise of cryptocurrencies, the need for secure storage solutions has become increasingly important.

Cryptocurrency wallets come in various forms, but their primary function is to securely store your digital assets. This is achieved through the use of public and private keys, which are fundamental to understanding how cryptocurrency storage works.

The Basics of Cryptocurrency Storage

Cryptocurrency storage is based on a pair of keys: a public key and a private key. The public key is used to receive cryptocurrencies, similar to how an account number is used in traditional banking. On the other hand, the private key is used to send cryptocurrencies and should be kept secure to prevent unauthorized access to your funds.

The security of your cryptocurrency is directly tied to the security of your private key. Losing your private key can result in the loss of your cryptocurrency, as it cannot be recovered.

| Key Type | Function | Security Consideration |

|---|---|---|

| Public Key | Receiving Cryptocurrency | Can be shared publicly |

| Private Key | Sending Cryptocurrency | Must be kept secure and private |

Public and Private Keys Explained

Understanding the difference between public and private keys is crucial for managing your cryptocurrency effectively. Your public key is like your bank account number; you can share it with others so they can send you cryptocurrency. In contrast, your private key is like your PIN or password; it should be kept confidential to prevent others from accessing your funds.

Managing these keys effectively is key to securing your cryptocurrency. Using a reputable cryptocurrency wallet can help in generating and storing these keys securely.

Understanding Hot Wallets: The Connected Option

In the world of cryptocurrency, hot wallets represent a connected storage solution. These wallets are designed to be accessible online, making it easier for users to manage their digital assets. A hot wallet is essentially a software program that stores the private keys to your cryptocurrency, allowing for quick transactions.

Definition and How Hot Wallets Work

A hot wallet works by connecting to the internet, enabling users to send, receive, and manage their cryptocurrencies. This is achieved through a software application that securely stores the user’s private keys. The convenience of hot wallets lies in their ability to facilitate rapid transactions, making them ideal for active traders and users who need to access their funds frequently.

Key characteristics of hot wallets include:

- Internet connectivity

- Easy access to cryptocurrency

- Software-based

- Facilitates quick transactions

Types of Hot Wallets

Hot wallets come in various forms, catering to different user preferences and needs. The primary types include mobile, desktop, and web wallets.

Mobile Wallets

Mobile wallets are applications designed for smartphones, providing users with the ability to manage their cryptocurrencies on-the-go. Examples include Trust Wallet and MetaMask Mobile. These wallets are convenient for everyday transactions.

Desktop Wallets

Desktop wallets are software applications installed on a computer, offering a more secure environment than web wallets. Popular desktop wallets include Exodus and Electrum. They provide a balance between security and accessibility.

Web Wallets

Web wallets are online services that allow users to store and manage their cryptocurrencies through a web interface. While convenient, they are more vulnerable to hacking. Examples include web-based versions of Blockchain.com and Coinbase.

Each type of hot wallet has its advantages and disadvantages, and the choice depends on the user’s specific needs and preferences. Understanding these differences is crucial for selecting the most appropriate hot wallet.

Cold Wallets: Secure Offline Storage Solutions

Cold wallets provide a safe haven for cryptocurrency assets, protecting them from online vulnerabilities. By storing cryptocurrencies offline, cold wallets significantly reduce the risk of hacking and cyber theft, making them an attractive option for long-term investors.

Definition and How Cold Wallets Work

A cold wallet is a type of cryptocurrency storage that is not connected to the internet, thereby enhancing security. Cold wallets work by generating and storing private keys offline, ensuring that transactions are signed without exposing the keys to online threats. This method provides a robust defense against hacking attempts and cyber attacks.

Types of Cold Wallets

Cold wallets come in various forms, each offering unique benefits. The primary types include hardware wallets, paper wallets, and physical bitcoin.

Hardware Wallets

Hardware wallets are physical devices designed to securely store private keys. Brands like Ledger and Trezor are popular choices among cryptocurrency investors. These wallets are user-friendly and offer advanced security features, making them a preferred option for those who want to balance security with convenience.

Paper Wallets

A paper wallet is a physical document that contains a cryptocurrency’s public and private keys. While they are a low-tech solution, paper wallets can be vulnerable to loss or damage. It’s essential to create multiple copies and store them in secure locations.

Physical Bitcoin

Physical bitcoin refers to a coin or token that contains a private key, often embedded in a physical object. These are more of a novelty but can serve as a secure way to gift or store small amounts of cryptocurrency.

In conclusion, cold wallets offer a range of secure storage solutions for cryptocurrency investors. By understanding the different types and their benefits, individuals can make informed decisions about how to protect their digital assets.

Hot vs Cold Wallets: A Comprehensive Comparison

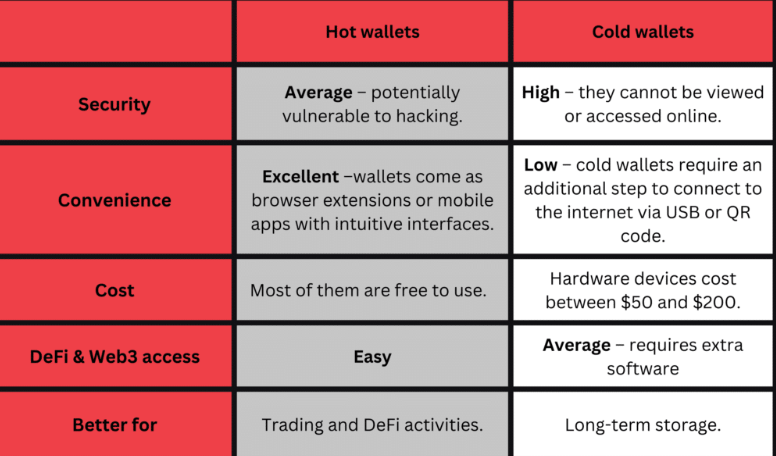

Understanding the differences between hot and cold wallets is essential for any cryptocurrency investor. Both types of wallets have their unique advantages and disadvantages, which are crucial to consider when deciding where to store your digital assets.

Security Differences

The most significant difference between hot and cold wallets lies in their security features. Cold wallets are generally considered more secure because they store cryptocurrencies offline, making them less vulnerable to hacking attempts. In contrast, hot wallets are connected to the internet, increasing their risk exposure. Here are some key security differences:

- Cold Wallets: Offline storage, reduced risk of hacking, and better protection against malware.

- Hot Wallets: Connected to the internet, more susceptible to cyber attacks, but often have robust security measures like two-factor authentication.

Accessibility and Convenience

Hot wallets are designed for frequent transactions and are typically more user-friendly, making them ideal for active traders. They provide quick access to your cryptocurrencies, enabling you to buy, sell, or transfer assets rapidly. On the other hand, cold wallets are more suited for long-term storage and may require more steps to access your funds.

The trade-off between security and accessibility is a key consideration. While cold wallets offer enhanced security, they can be less convenient for frequent transactions. Here are some points to consider:

- Hot wallets offer ease of use and quick access to your cryptocurrencies.

- Cold wallets provide enhanced security but may require more time to access your assets.

Cost Considerations

The cost of using a hot or cold wallet can vary significantly. Some hot wallets are free or low-cost, while others may charge fees for certain transactions. Cold wallets, especially hardware wallets, can range from $50 to over $200, depending on the brand and features.

When evaluating the cost, consider the following:

- Transaction fees associated with hot wallets.

- The initial cost of purchasing a cold wallet, such as a hardware wallet.

Recovery Options

In case you lose access to your wallet, recovery options are crucial. Most wallets provide a recovery phrase or seed to restore access. It’s essential to store this information securely to prevent loss of assets.

Some key recovery options include:

- Recovery phrases or seeds provided by most wallets.

- Two-factor authentication to add an extra layer of security.

Security Risks and How to Mitigate Them

The security of cryptocurrency wallets is a multifaceted issue, involving various risks for both hot and cold storage solutions. As the crypto market continues to grow, understanding these risks is essential for protecting your digital assets.

Common Threats to Hot Wallets

Hot wallets, being connected to the internet, are more susceptible to cyber threats. Common threats include phishing attacks, where hackers trick users into revealing their login credentials, and malware, which can compromise a device’s security. To mitigate these risks, it’s crucial to use reputable antivirus software and be cautious of suspicious emails or links.

Potential Vulnerabilities in Cold Storage

Cold wallets, while more secure due to their offline nature, are not entirely risk-free. Physical theft or damage can compromise a cold wallet. Additionally, if the recovery seed is not stored securely, it can be accessed by unauthorized parties. To safeguard against these vulnerabilities, it’s recommended to store cold wallets in secure locations and to use multiple backups of the recovery seed.

Best Practices for Wallet Security

Regardless of the wallet type, several best practices can enhance security. These include enabling two-factor authentication (2FA), using strong, unique passwords, and keeping software up-to-date. For added security, consider using a hardware wallet for storing large amounts of cryptocurrency.

By understanding the security risks associated with crypto wallets and implementing these best practices, users can significantly reduce the risk of their digital assets being compromised.

The Best Crypto Wallets for Different User Types

Choosing the right crypto wallet is crucial for a seamless and secure cryptocurrency experience. The best crypto wallet for you depends on whether you’re a beginner, an active trader, or a long-term investor. Different user types have different needs, and understanding these needs is key to selecting the most appropriate wallet.

For Beginners

For those new to cryptocurrency, a user-friendly wallet with robust security features is essential. MetaMask is a popular choice among beginners due to its ease of use and compatibility with various cryptocurrencies. It offers a simple interface and integrates well with decentralized applications (dApps).

For Active Traders

Active traders require wallets that can handle frequent transactions quickly and securely. Trust Wallet is a favorite among traders because it supports a wide range of cryptocurrencies and has a built-in DApp browser, enabling traders to access multiple trading platforms directly.

For Long-term Investors

Long-term investors prioritize security and often opt for wallets that offer robust protection against potential threats. Ledger Nano X is a highly recommended cold wallet for long-term investors due to its advanced security features, including offline storage and two-factor authentication.

For Maximum Security

For users who prioritize maximum security, hardware wallets are the way to go. Trezor Model T offers advanced security features, including encryption and secure chip technology, making it one of the most secure options available. It also supports a wide range of cryptocurrencies and has a user-friendly interface.

In conclusion, the best crypto wallet for you depends on your specific needs and usage patterns. By understanding the different types of wallets available and their features, you can make an informed decision that aligns with your cryptocurrency goals.

Popular Crypto Wallets in the Market Today

With the rise of cryptocurrencies, numerous wallet solutions have emerged, catering to different user needs. The market now offers a variety of options for storing, sending, and receiving digital assets.

Top Hot Wallet Options

Hot wallets are connected to the internet, providing ease of access and convenience for frequent transactions. Here are some of the most popular hot wallet options:

Coinbase Wallet

Coinbase Wallet is a user-friendly hot wallet that supports a wide range of cryptocurrencies. It offers a simple interface and robust security features, making it a popular choice among beginners.

MetaMask

MetaMask is a widely-used hot wallet that allows users to interact with decentralized applications (dApps) on the Ethereum network. It provides a secure and convenient way to manage Ethereum-based assets.

Trust Wallet

Trust Wallet is a mobile hot wallet that supports over a million different cryptocurrencies. It is known for its ease of use and advanced security features, including biometric authentication.

Exodus

Exodus is a desktop hot wallet that offers a sleek and intuitive interface. It supports a variety of cryptocurrencies and provides users with a built-in exchange feature.

Leading Cold Wallet Solutions

Cold wallets offer enhanced security by storing private keys offline. Here are some of the leading cold wallet solutions:

Ledger Nano X

Ledger Nano X is a popular cold wallet that supports over 1,500 cryptocurrencies. It features Bluetooth connectivity and a user-friendly interface, making it a favorite among crypto enthusiasts.

Trezor Model T

Trezor Model T is a high-end cold wallet that offers advanced security features, including a touchscreen interface and passphrase protection. It supports a wide range of cryptocurrencies.

KeepKey

KeepKey is a cold wallet that features a large screen and supports multiple cryptocurrencies. It is designed to be user-friendly while maintaining high security standards.

CoolWallet Pro

CoolWallet Pro is a card-like cold wallet that offers a unique design and robust security features. It supports a variety of cryptocurrencies and is designed for ease of use.

Creating a Multi-Wallet Strategy for Optimal Security

To optimize security, cryptocurrency users are increasingly adopting a multi-wallet strategy. This approach involves using different types of wallets for various purposes, enhancing overall security and flexibility.

The Hot-Cold Combination Approach

A popular method within a multi-wallet strategy is the hot-cold combination approach. This involves maintaining both a hot wallet for frequent transactions and a cold wallet for secure, long-term storage. By doing so, users can balance the need for accessibility with the need for security.

For instance, a user might keep a small amount of cryptocurrency in a hot wallet for daily transactions, while storing the majority of their assets in a cold wallet. This way, even if the hot wallet is compromised, the loss is limited.

Diversifying Across Multiple Wallets

Another key aspect of a multi-wallet strategy is diversifying across multiple wallets. This can involve using different wallet providers, or different types of wallets (e.g., hardware, software, and paper wallets). By spreading assets across multiple wallets, users can reduce their reliance on a single wallet, thereby minimizing risk.

Diversification can also extend to using wallets with different security features or storing assets in different locations. This layered approach to security can significantly enhance the protection of cryptocurrency holdings.

In conclusion, a well-planned multi-wallet strategy can offer enhanced security and flexibility for cryptocurrency users. By adopting a hot-cold combination approach and diversifying across multiple wallets, users can better safeguard their digital assets.

Conclusion: Making the Right Choice for Your Crypto Journey

Choosing the right crypto wallet is a crucial step in your crypto journey. With the various options available, it’s essential to consider your specific needs and preferences. Whether you’re a beginner, an active trader, or a long-term investor, selecting a wallet that aligns with your goals is vital.

Hot wallets, such as those offered by Coinbase and Binance, provide ease of access and convenience for frequent transactions. On the other hand, cold wallets, like Ledger and Trezor, offer enhanced security for storing cryptocurrencies offline. By understanding the strengths and weaknesses of each type, you can make an informed decision.

A multi-wallet strategy can also be beneficial, allowing you to diversify your storage solutions and optimize security. By combining hot and cold wallets, you can enjoy the benefits of both convenience and security. Ultimately, choosing the right wallet is a personal decision that depends on your unique requirements and risk tolerance.

As you continue on your crypto journey, remember to stay informed and adapt to the evolving landscape. By doing so, you’ll be better equipped to navigate the world of cryptocurrencies and make the most of your investments.

FAQ

What is the main difference between a hot wallet and a cold wallet?

The primary difference lies in their connection to the internet. Hot wallets are connected, making them more convenient but also more vulnerable to hacking. Cold wallets, on the other hand, are offline, offering enhanced security but less convenience.

Are hot wallets or cold wallets more suitable for beginners?

For beginners, hot wallets like Coinbase Wallet or MetaMask are often more user-friendly and easier to set up. They provide a straightforward way to start with cryptocurrency.

How do I secure my private keys in a cold wallet?

To secure your private keys in a cold wallet, it’s essential to store the wallet in a safe place, such as a safe or a locked cabinet. Additionally, consider making a backup of your private keys and storing it securely.

Can I use multiple wallets for different purposes?

Yes, using a multi-wallet strategy can be beneficial. For example, you can use a hot wallet for daily transactions and a cold wallet for long-term storage. This approach enhances security and flexibility.

What are some best practices for wallet security?

Best practices include enabling two-factor authentication, using strong passwords, keeping your wallet software up to date, and being cautious of phishing attempts. For cold wallets, it’s crucial to store them in a secure location.

How do I choose the right crypto wallet for my needs?

To choose the right wallet, consider your specific needs, such as the type of cryptocurrency you want to store, your level of experience, and your security requirements. Research different wallets, such as Ledger Nano X or Trezor Model T, to find the one that best fits your needs.

Are there any costs associated with using crypto wallets?

Yes, some wallets charge fees for transactions or other services. For example, Exodus and Trust Wallet may have different fee structures. It’s essential to understand the costs associated with your chosen wallet.

Can I recover my cryptocurrency if I lose access to my wallet?

Recovery options vary depending on the wallet. Some wallets, like MetaMask, provide a seed phrase that can be used to recover your account. It’s crucial to follow the wallet’s recovery instructions carefully.