Curious about the future of cryptocurrency? Discover if is bitcoin a good investment 2025 by exploring the latest trends and expert insights on our blog.

As the cryptocurrency market grows, more people are looking at digital assets like Bitcoin. The value of Bitcoin can change because of institutional interest, how the economy is doing, and new technology. When more people use bitcoin ETFs or when market sentiment shifts, these things can cause its price to go up or down. Bitcoin is always reacting to different market dynamics. That is why it is important to know about its past performance and what might come next. This look at Bitcoin tries to give ideas about whether it could be a good investment by the end of 2025.

Key Highlights

- Bitcoin’s price has shown significant volatility through recent years, hitting record highs while attracting institutional investors’ interest.

- The approval and adoption of Bitcoin ETFs in the United States have become game-changers for mainstream acceptance.

- Macroeconomic factors like inflation, interest rates, and global uncertainty continue to shape the cryptocurrency industry.

- Bitcoin remains a unique digital asset valued as a “store of value,” similar to gold.

- Key technological advancements and security upgrades are set to drive the Bitcoin network’s future growth.

- Regulatory and legal developments, especially in the U.S., hold the potential to transform the crypto market further.

The Current State of Bitcoin in 2024

There is now a big increase in institutional interest in Bitcoin in 2024. Many major corporations are starting to add Bitcoin to their plans for managing money. They want to use it as a store of value.

Market dynamics still show that the price can go up or down a lot. This is because of bigger changes in the economy and new rules that influence how people feel about investing.

The launch of Bitcoin ETFs has helped digital assets become more trusted. Because of this, both regular people and big, institutional investors are paying more attention.

When interest rates change, there is a strong reaction in the cryptocurrency market. This can make people feel both hopeful and careful at the same time.

Key Milestones and Recent Price Movements

Bitcoin has hit some big moments on its way up, especially lately as its price got close to its time highs. The crypto market saw a strong rise, and this made many institutional investors feel positive about where things are going. Market conditions right now show high volatility, but the way things look, some people think there could be long-term gains. The use of financial products, like spot bitcoin ETFs, shows that there is growing institutional interest in digital assets. With problems in the economy hanging over everyone, these changes are a big part of how Bitcoin is seen in the investment world.

Adoption Trends in the United States

In recent years, the use of digital assets in the United States has gone up a lot. Many major corporations now include bitcoin in their reserves. This move boosts mainstream acceptance of bitcoin with both consumers and investors. At the same time, banks and other financial institutions are bringing out products such as spot bitcoin ETFs. These products make it easier for more people and groups to get involved. This mix of new interest—from institutional investors and regular people—shows how market sentiment is changing. Big macroeconomic factors and new rules around digital assets help shape this change. All these pieces come together to make a better climate for bitcoin’s price growth as we head toward 2025.

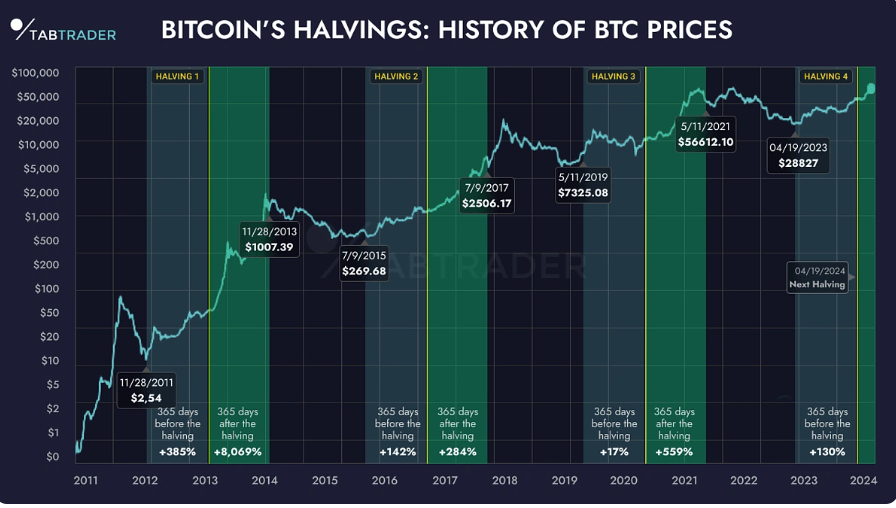

Historical Performance of Bitcoin

Looking at how the bitcoin market has moved over time shows that there are big cycles. There are times when prices go up a lot and other times when they fall. The bigger bull runs in the bitcoin market have come when there is strong institutional interest. This often pushes bitcoin’s price to new highs. On the other hand, when the market moves down, it shows how unpredictable the crypto industry can be. It also shows how much the market depends on big things happening in the world, like macroeconomic factors.

If you use technical analysis, you can try to spot these patterns. This could help you make better moves when you buy or sell. What happened in previous years teaches us that market sentiment—the way people feel about the market—along with things outside the market, can really affect bitcoin’s price. To do well in the future, it helps to know all this and to look out for changes in what people and big groups do in the crypto industry.

Major Bull and Bear Cycles

Knowing about major bull and bear cycles helps you deal with the big ups and downs of Bitcoin. In the past, there have been strong bull runs. These have often happened when there is more mainstream acceptance and more people from big companies getting involved, which is called institutional interest. Price surges usually show up when macroeconomic conditions are good. This makes many investors feel positive.

On the other hand, bear cycles happen when there are outside reasons like new rules or changes in market sentiment. These external factors can make traders more careful. If you can spot these cycles, you may have a better chance at making smart choices and taking advantage of the market dynamics at the time.

Lessons from Past Market Trends

Changes in Bitcoin’s price over the years give important ideas for new investments. The way people feel about the market can go from very hopeful to very careful. This often matches the ups and downs in the greed index. If we look at past years, we see that what investors do can make the price go up or down. Quick jumps in price may bring fast money. But these are almost always followed by price drops.

Using technical analysis to find support and resistance levels can help people move through the crypto market. It is good to stay up to date about outside macroeconomic factors, too. This helps institutional investors make choices that stop big risks and let them catch new chances.

Factors Influencing Bitcoin’s Price in 2025

Several macroeconomic factors will be important in shaping the price of BTC in 2025. Things like inflation worries and interest rates will matter a lot. These will change how institutional investors and public companies plan their investments. At the same time, new rules and legal changes may help more institutional adoption. This could lead to more mainstream acceptance of bitcoin as a store of value. All these external factors and macroeconomic uncertainty will guide how people feel in the crypto market. They will shape market dynamics and have an impact on the high volatility and price of BTC.

Macroeconomic Drivers and Inflation Concerns

Global economic conditions have a big effect on bitcoin’s price. When inflation goes up and down, more people look at bitcoin as a store of value. This makes both big companies and everyday people more interested in using it. When there is high inflation, many investors want to put money in other things, and this helps the crypto market.

Interest rates and macroeconomic uncertainty also have a strong impact on market sentiment. They help shape how people feel about different financial products. All these factors together are important for seeing where bitcoin will go in the future and for any price predictions about its future growth.

Impact of Regulation and Legal Developments

Dealing with the changing rules about digital assets can really affect Bitcoin’s price and how many people use it. When there is more watchfulness from government groups, it can lead to market ups and downs. This can also change how much interest big investors have and impact the whole crypto market. If the news about these rules is good, it often helps the market feel positive, and that can take Bitcoin to new heights in its market cap. But if rules get too strict, people who want to invest for the first time might stay away, and this could slow down new ideas in the cryptocurrency industry. As laws become clearer, Bitcoin’s place as a store of value and as something people can invest in will depend on these big picture, or macroeconomic factors, and on how the world handles digital assets.

Institutional Interest and Investment in Bitcoin

There is now more institutional interest in Bitcoin than ever before. Big companies and public companies have started to put more money into it. The launch of bitcoin ETFs has made it easier for these institutional investors to get involved. Now, many of them want to use Bitcoin as a strategic bitcoin reserve. Because more financial institutions see Bitcoin as a good store of value, the market sentiment now leans towards keeping it for the long term. Things like changing interest rates and worries about inflation also play a part. These macroeconomic factors make people look at cryptocurrencies as good financial products. All of this has helped Bitcoin win more attention and respect from both new and old investors.

Role of U.S. Financial Institutions

U.S. financial institutions are playing a big part in the world of cryptocurrency, especially when it comes to Bitcoin. More and more, you will see institutional adoption of Bitcoin. This means people are starting to see Bitcoin as an asset class that is real and important. Major corporations and public companies now want to add Bitcoin to their portfolios. The money coming in from them is starting to change the whole market dynamics.

Along with this, the launch of bitcoin etfs makes it easier for more people and institutional investors to join in. Both retail and institutional investors now have ways to access this digital asset, which helps improve overall market sentiment.

As the rules and regulatory frameworks for crypto change, all these institutions will have a key job. They will help drive mainstream acceptance and push the world of Bitcoin forward.

Effect of Bitcoin ETFs and Mainstream Products

Emerging financial products like Bitcoin ETFs have changed the crypto market. They help with more institutional interest and lead to more mainstream acceptance. Now, institutional investors can get involved with bitcoin’s price changes without having to own the coin themselves. This makes it easier for them, as they do not have to worry about where to keep their coins or how to keep them safe.

Major corporations are now looking into using bitcoin in their business. They may keep strategic bitcoin reserves. When this happens, the demand for bitcoin-derived financial products will likely go up. This change does not just make bitcoin look like a better store of value. It can also help keep its price stable when the crypto market gets rough. All of this shows how the wider economic conditions and investor confidence are shaping what happens next.

Technological Advancements Affecting Bitcoin

New technology keeps changing how Bitcoin grows. The bitcoin network now handles things faster because of better network scalability. This means there are fewer delays, fixing the issues that used to slow people down in the past. Good security changes have made the bitcoin network safer. This helps people and big institutional investors trust it more. These changes make Bitcoin stronger and more steady as a store of value and a long-term choice for people’s money. As more way to improve show up, they help Bitcoin reach new heights. This helps its stand in the whole crypto market become even better.

Network Upgrades and Scalability Solutions

Recent changes in network upgrades are important for making Bitcoin work better when more people use it. The Lightning Network helps with this. It is a second layer that lets users have faster transactions and lower costs. This makes the crypto market better for everyone.

Scaling tools don’t just fix busy networks. They also help bring in more institutional investors and public companies. As technology gets better, these upgrades can be a big reason why Bitcoin continues to be seen as a strong store of value. Many people and investors want to know what these changes mean for the future growth of the cryptocurrency industry.

Security Enhancements and Their Impact on Trust

Ongoing improvements in bitcoin’s security help build trust with investors. Better encryption and multi-signature wallets help keep the bitcoin network safe. These tools also lower the chance of hacks or other problems. As more institutional investors join the crypto market, the need for strong security is more important than ever. When people see that these digital assets are well protected, both public companies and regular investors are more likely to get involved. This trust helps bitcoin stand out as a good and safe store of value, even when the crypto market can be changeable.

Bitcoin Price Predictions for 2025

Predicting the price of Bitcoin for 2025 is not simple. There are many things that can change the price, like market dynamics and macroeconomic uncertainty. Some experts believe that new bitcoin ETFs and more institutional interest could help Bitcoin reach new heights. This kind of excitement may bring a lot of future growth to the crypto market. But there are also some who are not as hopeful. They point to high volatility and worries about liquidity, which could slow down the interest people have in investing. In the end, the crypto market balance depends on how much people believe in future growth against the risks that come with it.

Bullish Scenarios: Analyst and Industry Optimism

More and more analysts and industry experts are hopeful about what Bitcoin could do in 2025. Many think that macroeconomic factors, like the drop in inflation and more institutional interest, will push Bitcoin to new heights. There is now a strong focus on spot Bitcoin ETFs and how major corporations are getting involved. This shows the crypto market could be moving toward real mainstream acceptance. All this excitement may help stabilize the crypto market. It might bring in more institutional investors and help Bitcoin keep its place as a store of value as different economic conditions change.

Bearish Scenarios: Risks and Warning Signs

Market sentiment in the crypto market can change very quickly, especially when it comes to Bitcoin. High volatility often makes institutional investors more careful. They might change their plans because of news about the economy or other external factors. Uncertainty over things like spot Bitcoin ETFs and other rules can also make people in the crypto industry feel uneasy. When interest rates go up or down, some financial products may start to look less good. This can pull the price of Bitcoin down. Because of all these factors together, investors in the crypto market who are careful should think hard before making any moves, especially with so much high volatility and shifting market sentiment.

Risks and Challenges of Investing in Bitcoin

Investing in Bitcoin comes with some risks and challenges. The crypto market has high volatility, which means that the price can go up or down very fast. These sharp changes can make even experienced investors feel nervous. There is also a risk with liquidity. You may not always be able to buy or sell at the price you want. Security problems can be a big issue too. If you do not keep your Bitcoin safe, you could lose a lot of money. It is important to know about these risks before you put your money in. If you want to have Bitcoin in your investment mix, you should learn good ways to manage these risks.

Market Volatility and Liquidity Risks

The crypto market often goes up and down in big ways. This creates a lot of market volatility that can make new investors think twice. The price of BTC can change a lot in a short time. Things like macroeconomic factors and market sentiment can have a big impact. Liquidity risks can also be a problem. This can happen if prices move fast or if the market goes down. It may be hard to buy or sell without a big change in the price.

It is important to know about these risks. Any investor should think about their risk tolerance before getting started in the crypto market. This is extra important if you want to use Bitcoin as a store of value. The financial landscape keeps changing, so you need to think about all these things.

Security Breaches and Custody Concerns

Security breaches and worries about safe keeping are big problems for people who put money into the cryptocurrency industry. Some well-known hacks have made people lose a lot of money. This makes many ask questions about how safe exchanges and wallets really are. When big companies, called institutional investors, handle large amounts of digital assets, it means strong safety steps are even more important. Using others to store these assets can make things simple, but it also means there are risks if that outside party has weak spots. As more people get into the market and it grows, you need to know about these problems. This will help you deal with changes in Bitcoin investment and keep your digital assets safe.

Comparing Bitcoin with Other Investments

The main appeal of digital assets like Bitcoin is that it can work as a store of value and an investment that some people hope will go up in price. Bitcoin, compared to assets like stocks or gold, shows high volatility. That means its price can go up or down a lot in a short time. People who want to make their portfolios different may see both chances and risks with Bitcoin. There is growing institutional interest in Bitcoin, and the way it reacts to macroeconomic factors sets it apart from more common types of investments. The market dynamics of Bitcoin are unique, which can make it a good pick for those who will put in the time to understand and handle its ups and downs.

Bitcoin vs. Traditional Assets (Stocks, Gold)

Looking at the differences between Bitcoin and traditional assets like stocks and gold gives investors some important things to think about. Stocks often go up and down because of how companies are doing and big changes in the economy. Bitcoin, on the other hand, has special features since it is a decentralized digital asset. Many people see Bitcoin as a store of value and use it as a way to keep their money safe from inflation, especially when the economy is not steady. Gold has been known for a long time as a safe option for investors. Still, Bitcoin stands out in the crypto market because there is a chance to get high returns. This chance for big growth in value comes with both risk and rewards, making it an option for new ways to invest money.

How Bitcoin Fits into a Diversified Portfolio

Adding bitcoin to a mix of investments can give a good mix of growth and risk control. Bitcoin is a digital asset. It can help protect against inflation. You also get to take part in the high volatility of the crypto market. Putting bitcoin in your plan can make your total returns better, mainly when the market is going up. Bitcoin does not move the same way as things like stocks or gold. Because of this, investors have a way to protect their investments from quick market changes. The best way to do this is to look at your own risk tolerance and pay attention to current market conditions. This is key to getting helpful investment advice.

Conclusion

Investing in Bitcoin can give you chances to make money, but it also comes with risks in the ever-changing crypto market. Things like the interest from big financial groups and changes in the world’s economy will play a big part in about where the price of BTC goes in 2025. You need to know about high volatility and really think about your own risk tolerance before putting in your money. When Bitcoin gets more mainstream acceptance, it may become a stronger store of value. If you want to do well, you will need long-term planning and some basic technical analysis to help you handle all the market dynamics and reach your money goals.

Frequently Asked Questions

Is it too late to invest in Bitcoin in 2025?

As Bitcoin keeps changing, there could still be some good chances for investors in 2025. Looking at market conditions, seeing how new technology is being used, and watching for more institutional interest can help people decide what to do. You can use these things to judge if now is a good time to invest or if it might be better to wait and get better results later.

What are the biggest risks for U.S. investors in Bitcoin?

U.S. investors need to know about the risks that come with Bitcoin. The price of Bitcoin can go up and down fast, which may cause big losses. Rules around Bitcoin can also change, making it hard to see if you can get or use it in the future. There are also worries about safety, like hacking or losing your private keys. All these things mean you should think hard before you put your money in Bitcoin.

Can Bitcoin reach a new all-time high in 2025?

Some analysts say that Bitcoin could hit a new record high in 2025. This might happen because there is more institutional interest and new technology is coming in. But, the market can be very up and down. Worries about rules and laws could also change where its price goes.

How does regulation in the U.S. affect Bitcoin investment?

Regulation in the U.S. does have a big effect on Bitcoin investments. It is one of the things that shapes the market. The way rules are set can change how steady the market is and how much people trust it. If there are clear rules, more people might choose to take part in Bitcoin. Big investors and companies may also decide to come in. But, if the rules are too strict, there can be some problems. There might be limits that slow things down. This could hurt trading, cause prices to swing, and make the whole market less active. All of this shows just how important rules are in the world of cryptocurrency.

Should beginners consider Bitcoin for long-term growth?

Bitcoin can look good to people who are new to investing because of its history and growing use. But the price of Bitcoin can go up and down a lot. So, it’s important to be careful. If you own different types of investments and keep up with news, you can lower the risk that comes from how much Bitcoin’s price changes. This can help your money be safer over time.